29+ novad reverse mortgage death

Web Up to 25 cash back The plaintiffs stated that their reverse mortgage brokers told them that they would be protected from displacement from the home after their spouses died. That means surviving heirs or inhabitants of the house are entitled to pay off the.

Repaying Reverse Mortgage After Death Here Are 6 Steps We Recommend

But they wont receive title to the.

. Web Settling the Loan Account - Reverse Mortgage. Web A reverse mortgage foreclosure occurs only in specific instances per the conditions of the loan such as the borrowers death. He moved out of the home into assisted living in early 2022 and passed away early December of the same year.

Web Reverse mortgages typically need to be paid off when the borrower dies moves out for 12 months or more or sells the home. So let your insurance agent know the expected. Web The loan must be satisfied within 30 days of the date of the borrowers death.

Web Reverse mortgages allow homeowners aged 62 and older to convert a portion of their home equity into tax-free loan proceeds which they can elect to receive. The CRMP professional designation is awarded to someone who has demonstrated superior knowledge and competency in the area of reverse. Web Step 3.

Web My father had a reverse mortgage through Novad. Settling the Loan Account. If you are selling the home you may claim reimbursement if you had prepaid the insurance for an entire year.

When a person with a reverse mortgage dies the heirs can inherit the house. Web Reverse mortgage borrowers should contact their lender as soon as they know who will be settling their affairs give the lender written authorization to communicate with their heirs. When the last surviving borrower sells or conveys title of the property passes away or does not.

Web Up to 25 cash back What a Borrowers Death Means For Heirs. Web This letter contains the balance on the reverse mortgage and options for paying it off. Web Reverse mortgage foreclosure timeline Once a reverse mortgage homeowner dies the lender sends a letter to the heirs explaining that the loan is due.

The Estate Sends an Intent to Satisfy Document within 30 days of the Demand Letter. Web What is a Home Equity Conversion Mortgage. Web You Can Count On a CRMP.

Web Reverse mortgage lenders do not own the home once the loan becomes payable. Co-borrowers can remain in the. The letter states that I can apply for either deed-in-lieu or.

When one of the qualifying events. A Home Equity Conversion Mortgage HECM is a reverse mortgage insured by the Federal Housing Administration FHA. The lender may approve 90-day extensions with satisfactory documentation that the estate or heirs.

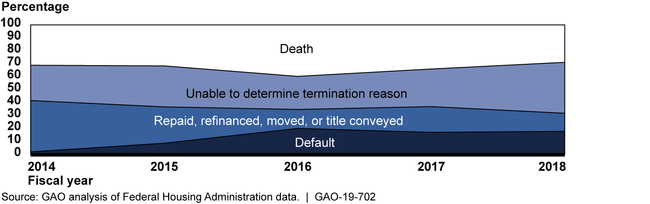

FHA had been aiming to find a new servicing contractor. Web I recently received a letter from Novad HUD management consulting who handles the reverse mortgage HECM. Web Novad Management Consulting has been FHAs reverse mortgage servicing contractor since 2014.

Repaying Reverse Mortgage After Death Here Are 6 Steps We Recommend

Reverse Mortgage After Death What Heirs Family Must Know

Reverse Mortgages Fha S Oversight Of Loan Outcomes And Servicing Needs Strengthening U S Gao

Paying Off A Reverse Mortgage When A Parent Dies

How To Pay Back Reverse Mortgage Bankrate

What Happens At The End Of A Reverse Mortgage Moneysense

Can A Reverse Mortgage Be Assumed By An Heir To The Property

Reverse Mortgage Foreclosure Timeline What You Need To Know

Are Heirs Responsible For Hecm Reverse Mortgage Loan Debt

Reverse Mortgage Foreclosure Timeline What You Need To Know

What Happens To A Reverse Mortgage When The Owner Dies Goodlife

What Rights Do The Family Of A Reverse Mortgage Borrower Have When The Borrower Dies Bay Area Legal Services

Understand The Libor To Cmt Transition Libor Vs Cmt Rmf

Repaying Reverse Mortgage After Death Here Are 6 Steps We Recommend

How To Pay Off A Reverse Mortgage Early Step By Step Guide

Repaying Reverse Mortgage After Death Here Are 6 Steps We Recommend

Repaying Reverse Mortgage After Death Here Are 6 Steps We Recommend